By James Van Straten (All times ET unless indicated otherwise)

After Wednesday’s unexpectedly high consumer price inflation (CPI) figures, all eyes now turn to the produce price report due at 8:30 a.m.

Analysts expect year-over-year PPI to come in at 3.2%, below December’s 3.3%, with a month-on-month reading of 0.3%, up from 0.2%. Core PPI, which strips out volatile food and energy prices, is expected to show underlying inflationary pressure, accelerating to 0.3% from 0% in December. From January last year, it’s seen easing to 3.3%.

Hotter-than-expected data could signal monetary policy remains too loose, potentially delaying or even eliminating Fed rate cuts this year, against President Trump’s wishes. A more restrictive Fed is likely to be bearish for risk assets. On the other hand, softer inflation data could weaken the dollar and lower treasury yields while helping boost risk-assets.

Following the CPI data markets were volatile.

Treasury yields surged to 4.6% before retreating slightly. The Dollar Index (DXY) mirrored this movement, spiking to 108.5 before pulling back below 108.

Despite the initial sell-off, major asset classes rebounded, with bitcoin (BTC), U.S. equities and gold finishing the session in the green.

Also on the agenda, Coinbase (COIN) reports fourth-quarter earnings after the market closes. Following Robinhood’s strong results, expectations are high, and a positive report could provide a boost to the cryptocurrency market. Stay Alert!

What to Watch

Crypto:

Feb. 13: Start of Kraken’s gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA clients. The process ends March. 31.

Feb. 13: Story (IP) mainnet launch.

Feb. 14: Dynamic TAO (DTAO) network upgrade goes live on the Bittensor (TAO) mainnet.

Feb. 14, 2:30 a.m.: Qtum (QTUM) hard fork network upgrade.

Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, starts reimbursing creditors.

Feb. 21: TON (The Open Network) becomes the exclusive blockchain infrastructure for messaging platform Telegram’s Mini App ecosystem.

Macro

Feb. 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’s Producer Price Index (PPI) report.

Core PPI MoM Est. 0.3% vs. Prev. 0%

Core PPI YoY Est. 3.3% vs. Prev. 3.5%

PPI MoM Est. 0.3% vs. Prev. 0.2%

PPI YoY Prev. 3.3%

Feb. 13, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims report for the week ended Feb. 8.

Initial Jobless Claims Est. 215K vs. Prev. 219K

Feb. 14, 8:30 a.m.: The U.S. Census Bureau releases January’s Retail Sales data.

Retail Sales MoM Est. -0.1% vs. Prev. 0.4%

Retail Sales YoY Prev. 3.9%

Earnings

Feb. 13: Coinbase Global (COIN), post-market, $2.11

Feb. 14: Remixpoint (3825)

Feb. 18: CoinShares International (CS), pre-market

Feb. 18: Semler Scientific (SMLR), post-market

Feb. 20: Block (XYZ), post-market, $0.88

Token Events

Governance votes & calls

Curve DAO is voting on increasing 3pool’s amplification coefficient to 8,000 over 30 days and raise admin fees to 100%. To optimize liquidity, as part of an experiment, 3pool will have higher fees while Strategic Reserves will offer lower fees.

Aave DAO is discussing using GHO as a gas token across various networks. The framework proposes using the canonical network bridge to mint GHO directly as a gas token.

Unlocks

Feb. 14: The Sandbox (SAND) to unlock 8.4% of circulating supply worth $80.5 million.

Feb. 16: Arbitrum (ARB) to unlock 2.13% of circulating supply worth $45.1 million.

Feb. 16: Avalanche (AVAX) to unlock 0.4% of circulating supply worth $42.8 million.

Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating supply worth $79 million.

Feb. 28: Optimism (OP) to unlock 2.32% of circulating supply worth $34.8 million.

Token Launches

Feb. 13: EthereumPoW (ETHW) and Polygon (MATIC) to no longer be supported at Deribit.

Feb. 13: Story (IP) to be listed on Bybit, Bitrue, Bitget, MEXC, KuCoin, and OKX, among others.

Feb. 14: Pudgy Penguins (PENGU) to be listed on Coinbase, according to a post shared by the Pudgy Penguins account.

Conferences:

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 2 of 2: Frankfurt Digital Finance (FDF) 2025

Day 1 of 2: The 4th Edition of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 24: RWA London Summit 2025

Feb. 25: HederaCon 2025 (Denver)

Derivatives Positioning

Funding rates in perpetual futures tied to SOL, TRS, TRON and DOT remain negative, indicating a bias for shorts, data from Coinglass and Velo Data show.

Annualized funding rates in BTC and ETH hover near 5%.

Most major coins, excluding BNB, have seen negative open-interest-adjusted cumulative volume deltas, a sign of net selling pressure, which raises a question mark on the sustainability of Wednesday’s post-U.S. CPI recovery.

BTC and ETH options skews are positive across the board, reflecting a bull bias.

Flows, however, have been muted, with some demand for out-of-the-money higher strike ETH calls, according to data sources Deribit and Paradigm.

Market Movements:

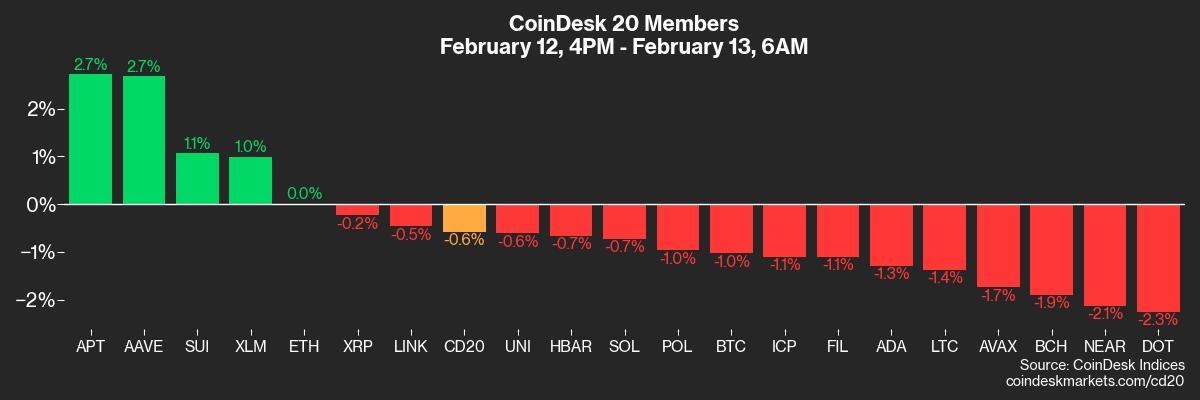

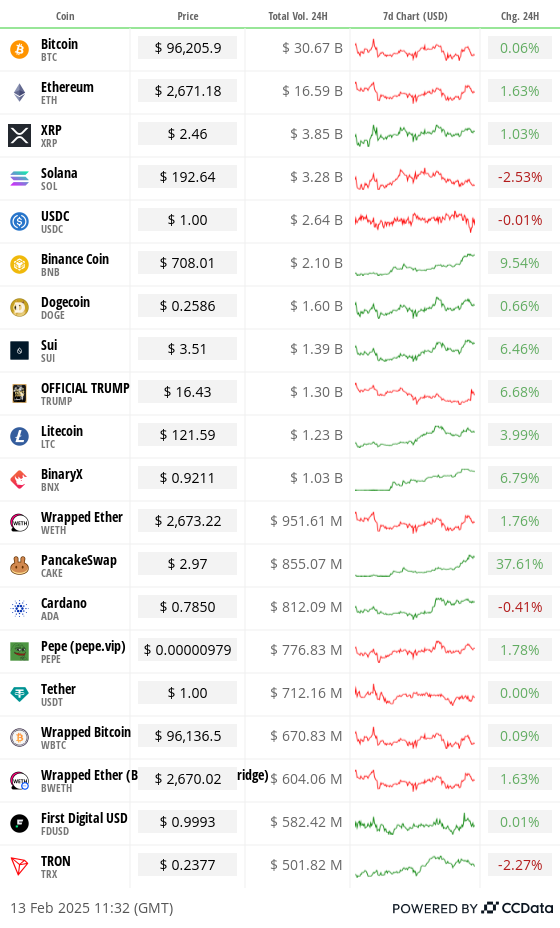

BTC is down 1.53% from 4 p.m. ET Wednesday to $96,206.67 (24hrs: -0.02%)

ETH is down 0.23% at $2,677.69 (24hrs: +1.79%)

CoinDesk 20 is down 0.71% to 3,201.06 (24hrs: +0.66%)

Ether CESR Composite Staking Rate is down 5 bps to 3.05%

BTC funding rate is at 0.0005% (0.5606% annualized) on Binance

DXY is down 0.34% at 107.58

Gold is up 1.26% at $2945.7/oz

Silver is up 0.49% to $32.85/oz

Nikkei 225 closed up 1.28% at 39,461.47

Hang Seng closed -0.20% at 21,814.37

FTSE is down 0.74% at 8,742.63

Euro Stoxx 50 is up 1.23% to 5,471.99

DJIA closed Wednesday -0.50% at 44,368.56

S&P 500 closed -0.24% at 6,051.97

Nasdaq closed 0.03% at 19,649.95

S&P/TSX Composite Index closed -0.27% at 25,563.1

S&P 40 Latin America closed -0.93% at 2,421.78

U.S. 10-year Treasury rate was down 2 bps at 4.61%

E-mini S&P 500 futures are unchanged at 6,073

E-mini Nasdaq-100 futures are up 0.17% at 21,842.75

E-mini Dow Jones Industrial Average Index futures are unchanged at 44,480

Bitcoin Stats:

BTC Dominance: 60.91 (-0.14%)

Ethereum to bitcoin ratio: 0.02784 (-0.50)

Hashrate (seven-day moving average): 802 EH/s

Hashprice (spot): $53.2

Total Fees: 4.63 BTC / $446,657

CME Futures Open Interest: 166,680 BTC

BTC priced in gold: 33.1 oz

BTC vs gold market cap: 9.40 oz

Technical Analysis

Since the Jan. 3 crash, bitcoin has remained below the widely-tracked 50-day simple moving average (SMA).

It now appears the price has also dipped below the Ichimoku cloud, suggesting a potential bearish momentum shift.

This twin breakdown could embolden bears. Immediate support is seen at around $90,000.

Crypto Equities

MicroStrategy (MSTR): closed on Wednesday at $326.82 (+2.3%), down 0.56% at $325 in pre-market.

Coinbase Global (COIN): closed at $274.90 (+3%), up 3.24% at $283.8 in pre-market.

Galaxy Digital Holdings (GLXY): closed at C$26.87 (+1.24%)

MARA Holdings (MARA): closed at $16.24 (+1.37%), down 0.55% at $16.16 in pre-market.

Riot Platforms (RIOT): closed at $11.16 (+0.18%), down 0.54% at $11.10 in pre-market.

Core Scientific (CORZ): closed at $12.09 (-1.39%), unchanged in pre-market.

CleanSpark (CLSK): closed at $10.52 (+2.33%), down 0.67% at $10.45 in pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.73 (+1.75%), unchanged in pre-market.

Semler Scientific (SMLR): closed at $47.69 (+1.51%), unchanged in pre-market.

Exodus Movement (EXOD): closed at $48.85 (-0.63%), up 2.48% at $50.06 in pre-market.

ETF Flows

Spot BTC ETFs:

Daily net flow: -$251 million

Cumulative net flows: $40.21 billion

Total BTC holdings ~ 1.174 million.

Spot ETH ETFs

Daily net flow: -$40.9 million

Cumulative net flows: $3.13 billion

Total ETH holdings ~ 3.788 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

Daily trading volumes in decentralized exchanges based on PancakeSwap have surged to the highest since early December.

The renewed activity partly explains CAKE token’s jump to a two-month high of $3.4.

While You Were Sleeping

Bitcoin Miner Riot Adds New Board Member to Push AI Pivot (CoinDesk): Bitcoin miner Riot Platforms added three new directors as it explores repurposing its mining infrastructure for AI workloads.

Bitcoin HODLer Metaplanet to Join MSCI Japan Index, Raises $26M to Buy More BTC (CoinDesk): The bitcoin buyer will be joining the MSCI Japan Index, which tracks the performance of large and mid cap Japanese stocks, on Feb. 28.

Coinbase Eyes Re-Entry to India (TechCrunch): The crypto exchange is reportedly working with Indian regulators to return to the crypto market it left in 2022 nearly six months after Binance resumed operations there.

Fed’s Waller Says Scale of Stablecoins Rests on Harmonized Rules (Bloomberg): Fed Governor Christopher Waller said stablecoins could strengthen the dollar globally, but need a U.S. regulatory framework that deals with their risks.

Ray Dalio to the Trump Administration: Cut Debt Now or Face an ‘Economic Heart Attack’ (CNBC): Citing the massive $36 trillion U.S. debt, Bridgewater’s Ray Dalio warns of a potential economic crisis unless the Trump administration urgently cuts the deficit to 3% of GDP from 7.5%.

In the Ether